The current economic landscape is marred by an alarming degree of unpredictability and turbulence.

Companies are struggling to navigate the treacherous waters of credit risk management. The unrelenting waves of uncertainty and volatility relentlessly pound at the foundations of businesses, threatening to capsize them at every turn. The sheer magnitude of the challenges faced by companies in this perilous economic climate is nothing short of daunting, leaving many grappling with how to survive the tumultuous tide.

The Covid-19 pandemic has caused a global economic slowdown, and many companies are facing declining revenues and increased pressure on cash flow. This has resulted in an increased risk of default, making credit risk management even more critical.

The Russia-Ukraine war has had a significant impact on credit risk in the region, particularly in Ukraine. The disruption of supply chains and the caused damage to infrastructure, leading to increased operational risk for businesses and potential loan defaults.

Recently, on March 10, 2023, Silicon Valley Bank (SVB) failed after a bank run, marking the second-largest bank failure in United States history and the largest since the 2008 financial crisis.

Covid-19 pandemic, the Russian-Ukraine war, the SVB collapse and other collapses that may come have highlighted the importance of credit risk management in the financial industry. It is essential for investors to understand the creditworthiness of borrowers and counterparties before investing in their securities.

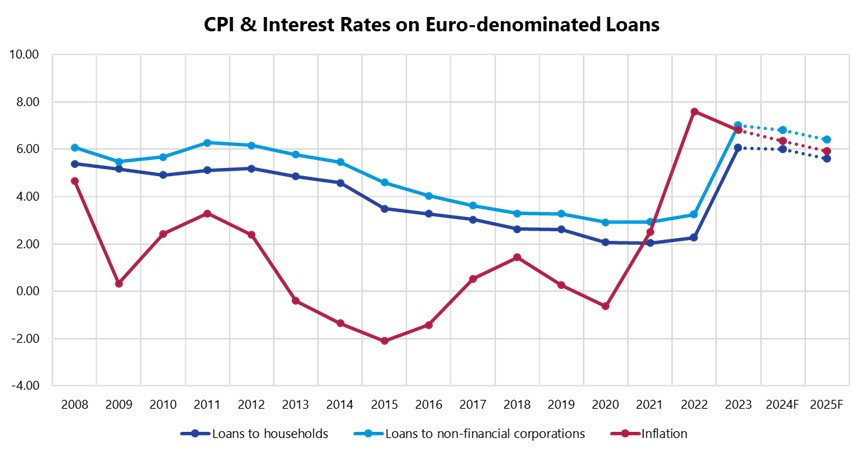

At the macro level, the economic developments have led to changes in interest rates, inflation rates, and exchange rates, which have all contributed to changes in credit risk. The increase in interest rates has made borrowing more expensive, while inflation has eroded the value of money, leading to increased risk for lenders. The volatility in exchange rates has also led to increased risk for businesses operating internationally, as changes in exchange rates can significantly impact their profitability and ability to service debt.

In 2020, the Cypriot Government increased specific expenditure categories such as subsidies from an average of €77 million to €578 million to support businesses and households.

Increased household incomes led to increased consumer spending, and limited supply boosted aggregate demand and created opportunities for businesses to raise the price of goods and services. As a result, countries worldwide saw the inflation rate rise to new heights. In Europe, inflation was mostly driven by the supply shock caused by the energy crisis.

Central Banks enacted monetary policy by raising interest rates and restricting the money supply to restore the inflation rate to a target of 2.0%. This policy is considered contractionary and affects a country's and its citizens' overall financial viability.

The current economic landscape is marred by an alarming degree of unpredictability and turbulence.

Companies are struggling to navigate the treacherous waters of credit risk management. The unrelenting waves of uncertainty and volatility relentlessly pound at the foundations of businesses, threatening to capsize them at every turn. The sheer magnitude of the challenges faced by companies in this perilous economic climate is nothing short of daunting, leaving many grappling with how to survive the tumultuous tide.

The Covid-19 pandemic has caused a global economic slowdown, and many companies are facing declining revenues and increased pressure on cash flow. This has resulted in an increased risk of default, making credit risk management even more critical.

The Russia-Ukraine war has had a significant impact on credit risk in the region, particularly in Ukraine. The disruption of supply chains and the caused damage to infrastructure, leading to increased operational risk for businesses and potential loan defaults.

Recently, on March 10, 2023, Silicon Valley Bank (SVB) failed after a bank run, marking the second-largest bank failure in United States history and the largest since the 2008 financial crisis.

Covid-19 pandemic, the Russian-Ukraine war, the SVB collapse and other collapses that may come have highlighted the importance of credit risk management in the financial industry. It is essential for investors to understand the creditworthiness of borrowers and counterparties before investing in their securities.

At the macro level, the economic developments have led to changes in interest rates, inflation rates, and exchange rates, which have all contributed to changes in credit risk. The increase in interest rates has made borrowing more expensive, while inflation has eroded the value of money, leading to increased risk for lenders. The volatility in exchange rates has also led to increased risk for businesses operating internationally, as changes in exchange rates can significantly impact their profitability and ability to service debt.

In 2020, the Cypriot Government increased specific expenditure categories such as subsidies from an average of €77 million to €578 million to support businesses and households.

Increased household incomes led to increased consumer spending, and limited supply boosted aggregate demand and created opportunities for businesses to raise the price of goods and services. As a result, countries worldwide saw the inflation rate rise to new heights. In Europe, inflation was mostly driven by the supply shock caused by the energy crisis.

Central Banks enacted monetary policy by raising interest rates and restricting the money supply to restore the inflation rate to a target of 2.0%. This policy is considered contractionary and affects a country's and its citizens' overall financial viability.

Figure 1

Recall that during 2021 and 2022, where interest rates for loans to households have been averaging at 2.15%, new loans for house purchases increased dramatically in 2022. (See Figure 1). As demand for house purchases increased, real estate prices were rising at an accelerating rate.

As of March 2023, interest rates on household loans are at 6.05%. According to the Labour Force Survey (LFS), unemployment, in monthly seasonally adjusted terms, increased to 7.4% in January 2023 compared to 6.0% in January 2022. Given the rise in interest rates and in conjunction with stagnant wages and rising unemployment, NPLs are expected to increase rapidly within the next 12 to 24 months.

At the micro level, the economic developments have impacted the creditworthiness of individual borrowers and businesses. Many businesses have experienced significant declines in revenue and profits, leading to cash flow issues and an increased risk of default. Similarly, individuals have lost jobs or seen their incomes decline, leading to increased risk of delinquency and default on loans and other debts.

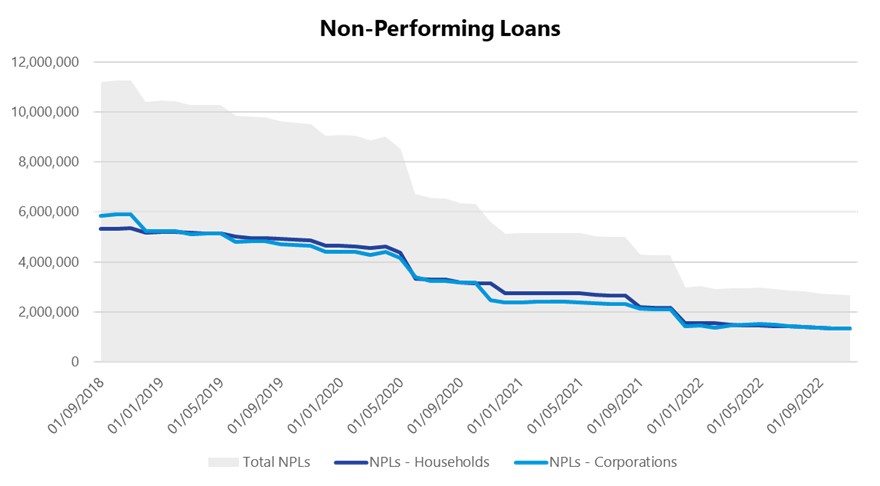

Constantinos Herodotou, Governor of the Central Bank of Cyprus (CBC), is searching for a way to reduce non-performing loans (NPLs) significantly. Under his direction, the CBC is launching a new initiative in collaboration with an international group of businesses specializing in NPLs, which can, as the Central Bank notes, reduce "red loans" and strengthen the banking industry (See Figure 2).

Figure 1

Recall that during 2021 and 2022, where interest rates for loans to households have been averaging at 2.15%, new loans for house purchases increased dramatically in 2022. (See Figure 1). As demand for house purchases increased, real estate prices were rising at an accelerating rate.

As of March 2023, interest rates on household loans are at 6.05%. According to the Labour Force Survey (LFS), unemployment, in monthly seasonally adjusted terms, increased to 7.4% in January 2023 compared to 6.0% in January 2022. Given the rise in interest rates and in conjunction with stagnant wages and rising unemployment, NPLs are expected to increase rapidly within the next 12 to 24 months.

At the micro level, the economic developments have impacted the creditworthiness of individual borrowers and businesses. Many businesses have experienced significant declines in revenue and profits, leading to cash flow issues and an increased risk of default. Similarly, individuals have lost jobs or seen their incomes decline, leading to increased risk of delinquency and default on loans and other debts.

Constantinos Herodotou, Governor of the Central Bank of Cyprus (CBC), is searching for a way to reduce non-performing loans (NPLs) significantly. Under his direction, the CBC is launching a new initiative in collaboration with an international group of businesses specializing in NPLs, which can, as the Central Bank notes, reduce "red loans" and strengthen the banking industry (See Figure 2).

Figure 2

Despite the unfavorable global climate, Cyprus's economy displayed commendable resilience in 2022, recording strong growth of 5,6% - Real GDP. The tourism sector is performing better than projected, the Cyprus economy is not dependent on Russian gas, and the financial industry has very little exposure to the Russian economy; therefore, the sanctions on Russia have not had a significant impact.

In addition, Cyprus's economic development is significantly fueled by foreign investment. On the 12th of March 2023, the Minister of Finance Makis Keravnos and the Minister of Investments of Saudi Arabia, Khalid Al Falih, who made an official visit to Cyprus, signed a Partnership Program Framework which deepens economic relations and highlights the potential for increased investment and trade between Cyprus and Saudi Arabia.

One of the biggest challenges that companies face in managing credit risk in the current environment is the lack of visibility into the financial health of their customers. The pandemic, Russia-Ukraine war and recent Banks’ collapses have led to significant disruptions in supply chains, making it difficult for companies to obtain accurate and up-to-date financial information on their customers. These had a significant impact on the financial health of many businesses, and some previously low-risk customers may now be at a higher risk of default. This lack of visibility can increase the risk of default and make it more difficult to make better informed strategic decisions.

Nevertheless, the above drawbacks do not imply that businesses are doomed to operate at high risk. Infocredit Group offers a variety of sophisticated tools and solutions that provide a holistic credit risk management approach.

Our team of experts can navigate you through a comprehensive range of services that assist you in managing credit risk effectively in a holistic approach. With the pre-assessment services, you can filter potential customers based on specific parameters and promote your services through our call center. The credit assessment reports, industry/competition analysis reports, and customer monitoring services help you make informed decisions. Additionally, the balance/debtor management and debt collection services can help you recover outstanding debts. Finally, our credit insurance services can reduce credit risk and help you grow your business safely and quickly. With these pillars in place, you can ensure the success of your business while minimizing the risks associated with credit.

By,

Stelios Komis, Credit Risk Manager, Infocredit Group

George Beitis, Financial Analyst, Infocredit Group

Infocredit Group, a leading provider of business intelligence and risk management solutions, including Credit Risk, AML/CTF regulatory compliance, Due Diligence and KYC can offers a wide range of tailormade, API driven solutions.

To talk with an Infocredit Group Credit Risk Management consultant please call 22398000 or email [email protected]

Figure 2

Despite the unfavorable global climate, Cyprus's economy displayed commendable resilience in 2022, recording strong growth of 5,6% - Real GDP. The tourism sector is performing better than projected, the Cyprus economy is not dependent on Russian gas, and the financial industry has very little exposure to the Russian economy; therefore, the sanctions on Russia have not had a significant impact.

In addition, Cyprus's economic development is significantly fueled by foreign investment. On the 12th of March 2023, the Minister of Finance Makis Keravnos and the Minister of Investments of Saudi Arabia, Khalid Al Falih, who made an official visit to Cyprus, signed a Partnership Program Framework which deepens economic relations and highlights the potential for increased investment and trade between Cyprus and Saudi Arabia.

One of the biggest challenges that companies face in managing credit risk in the current environment is the lack of visibility into the financial health of their customers. The pandemic, Russia-Ukraine war and recent Banks’ collapses have led to significant disruptions in supply chains, making it difficult for companies to obtain accurate and up-to-date financial information on their customers. These had a significant impact on the financial health of many businesses, and some previously low-risk customers may now be at a higher risk of default. This lack of visibility can increase the risk of default and make it more difficult to make better informed strategic decisions.

Nevertheless, the above drawbacks do not imply that businesses are doomed to operate at high risk. Infocredit Group offers a variety of sophisticated tools and solutions that provide a holistic credit risk management approach.

Our team of experts can navigate you through a comprehensive range of services that assist you in managing credit risk effectively in a holistic approach. With the pre-assessment services, you can filter potential customers based on specific parameters and promote your services through our call center. The credit assessment reports, industry/competition analysis reports, and customer monitoring services help you make informed decisions. Additionally, the balance/debtor management and debt collection services can help you recover outstanding debts. Finally, our credit insurance services can reduce credit risk and help you grow your business safely and quickly. With these pillars in place, you can ensure the success of your business while minimizing the risks associated with credit.

By,

Stelios Komis, Credit Risk Manager, Infocredit Group

George Beitis, Financial Analyst, Infocredit Group

Infocredit Group, a leading provider of business intelligence and risk management solutions, including Credit Risk, AML/CTF regulatory compliance, Due Diligence and KYC can offers a wide range of tailormade, API driven solutions.

To talk with an Infocredit Group Credit Risk Management consultant please call 22398000 or email [email protected]