INFOCREDIT GROUP IS OPTIMISTIC ABOUT THE NEXT TEN YEARS AND IS FOCUSING ON SUSTAINABLE DEVELOPMENT

The Cypriot economy is expected to find itself on a safer path than it did during the previous decade. “This is why we anticipate a healthier economy with good growth prospects,” says Theodoros Kringou, Managing Director of Infocredit Group, which has shifted its focus more towards sustainable development while maintaining a positive outlook for 2030.

INCREASED COMPETITION, TECHNOLOGICAL PROGRESS, ENERGY COSTS, THE AVAILABILITY OF FINANCE AND UNCERTAINTY ABOUT THE FUTURE ARE THE MAIN LONG- TERM CHALLENGES FACING CYPRIOT BUSINESSES

DYNAMISM AND FLEXIBILITY

Cyprus has rightly been described as one of the countries with the greatest potential for growth in the European Union over the next decade. It has a dynamic and flexible economy with solid foundations and is in a favourable position to deal with any challenges or pressures arising from the state of the global economy. A readiness to respond to international market trends and the successful collaboration between the private and public sectors are both key to its success

STRONG GROWTH

Despite the fact that the consequences of the financial crisis have not yet fully disappeared, economic growth in Cyprus remains strong. It may, of course, gradually slow down but it will not cease entirely, due to external factors such as trade wars, regional conflicts and/or political developments, such as the UK’s exit from the EU. Moreover, increased competition, technological progress, rising energy costs, the availability of finance and uncertainty about the future make up some of the main long-term challenges facing Cypriot businesses.

GREATER TRANSPARENCY

Feedback received from the market as well as from Infocredit Group’s own surveys reveals a general trend towards improved governance and greater transparency. Furthermore, companies are actively taking steps to become more aligned with current developments, which begins with complying with the most recent legislation and EU directives. One can observe that organisations are slowly starting to instil this in their corporate culture. This is encouraging since, over the next decade, we hope to see more and more companies operating under conditions of transparency. This move will allow market players to make the best use of the resources available, to reduce their business risk and avoid market traps.

A SAFER COURSE

One the other hand, increased pressure to comply with regulations regarding corruption, money laundering and terrorist financing has led to a growing number of companies which have started to implement due diligence processes to mitigate regulatory risks. Given this situation and assuming that compliance with legislation will continue to be upheld, we anticipate that the Cyprus economy will find itself on a safer path than it did during the previous decade. Consequently, we expect to see a healthier market with potential for growth. Let’s not forget that sustainable growth and social welfare are directly linked to the rule of law, transparency and the fight against corruption.

GROWTH SECTORS SERVICES

The fast-growing services sector is considered by many as the main driver of the Cypriot economy. The island has been transformed into an international business, finance and shipping hub. Benefits such as improved service quality, private sector support, market regulation and supervision through frequent amendments to the legal and institutional framework as well as fair competition and stability, are crucial to the sector’s ongoing growth.

TOURISM

The other two sectors fuelling our economy are tourism and construction. Despite its volatile nature, in recent years, tourism seems to have benefited from political developments and, as long as Cyprus steers clear of any regional conflicts, it is a sector which is expected to experience further expansion.

CONSTRUCTION

On the other hand, the construction sector has slowly recovered from the 2013 crisis and has started to grow once more. Of course, one cannot ignore the impact of the Cyprus Investment Programme on the particular sector, which has brought a surge in foreign investment to the island. Consequently, the influx of dubious capital may have created excessive optimism about the sector’s potentially unrealistic growth. The actual trend will become clear once anti-money laundering regulations become strictly enforced and when construction occurs in response to a genuine demand for it. For now, however, we remain optimistic since the revival of the sector is also visible from the rise in construction of high-rise towers and residences.

EDUCATION

In a small yet fast-paced economy such as ours, certain sectors still manage to surprise us in a positive way. For example, education has shown rapid growth in recent years, as the improved quality of local universities, combined with the new state of affairs following Brexit, appears to not only encourage Cypriot students to remain on the island but also entices foreigners to choose Cyprus as their destination of choice for continuing their higher education.

NATURAL GAS

There is no doubt that the discovery of natural gas in Cyprus has made the Oil and Gas industry a vital part of the Cyprus economy. The instability of the sector, however, does not allow for accurate predictions, since the prospect of potential energy pipelines has made the Mediterranean a battleground for surrounding nations with conflicting interests. As a consequence, existing uncertainties give an unclear picture of when we will actually see natural gas being extracted or even which countries will benefit from its distribution and sale and to what extent. Legally, Cyprus stands to gain from this undertaking, and by extension, its economy but from a global standpoint the allocation of wealth is directly linked to the balance of power between those involved. It appears that the process of natural gas extraction will be a slow one, with carefully planned, cautious action, in order to gain the greatest possible benefit without disrupting peace in the region.

THE ROLE OF INFOCREDIT GROUP

The business information sector, which is based on three main pillars – credit risk management, regulatory compliance and corporate governance – plays a crucial role in the long-term sustainability and smooth running of a business. Infocredit Group provides comprehensive business information and credit risk management solutions, through the use of artificial intelligence which is a must in today’s market in order to safeguard a company’s liquidity.

SECURITY SOLUTIONS

A company can derive great value and efficiency through its human capital and other resources especially if it applies corporate governance principles and complies with compliance regulations in relation to money laundering and terrorism financing, thus improving its prospects for long-term growth. By constantly refining our services and seeking new ways to develop our existing product lines and add new ones, we always endeavour to be first, not only in terms of making use of the latest technology where applicable but also in our effort to be in line with current trends, offering the tools necessary for success and the reduction of risks.

ARTIFICIAL INTELLIGENCE

At the recent Credit Risk Management Forum, organised by Infocredit Group, all aspects of credit risk were discussed, including financial, legal and political as well as funding methods. There was a notable interest around the subject of Artificial Intelligence (AI) and how through new technology, official and unofficial financial sources can be combined together with references in the media, to create a full picture of how a business is functioning.

STATE SUPPORT

State support of the private sector and the presence of market regulation and supervision maintain conditions of macroeconomic stability and a favourable business environment through frequent amendments to the legal and regulatory framework and safeguard fair competition. In this way, the state can reinforce entrepreneurship and contribute to business sustainability and growth.

STAMPING OUT CORRUPTION

Suppressing corruption and enforcing conditions of transparency and regulatory compliance is of paramount importance, and promotes a feeling of security in the market, as does the maintenance of strong international relations and the maximisation of our resources.

THE COMMON GOOD

Infocredit Group remains committed to its principles while aiming to be a modern, flexible organisation that benefits society. The company strives to be a leading provider of innovative solutions for credit risk management, regulatory compliance and corporate governance, by constantly improving its product quality to meet its clients’ needs.

INTERNATIONAL PARTNERSHIPS

Our international partnerships with reputable organisations such as LexisNexis Risk Solutions in the compliance discipline, VinciWorks in the field of online professional training as well as the Chartered Governance Institute (ICSA) in the UK allow us to look beyond the borders of Cyprus. With offices in the UAE and a strong presence in Greece, Malta, Russia and Ro- mania, we constantly work towards achieving market growth through the provision of cutting-edge solutions which are aligned with developments in the global market.

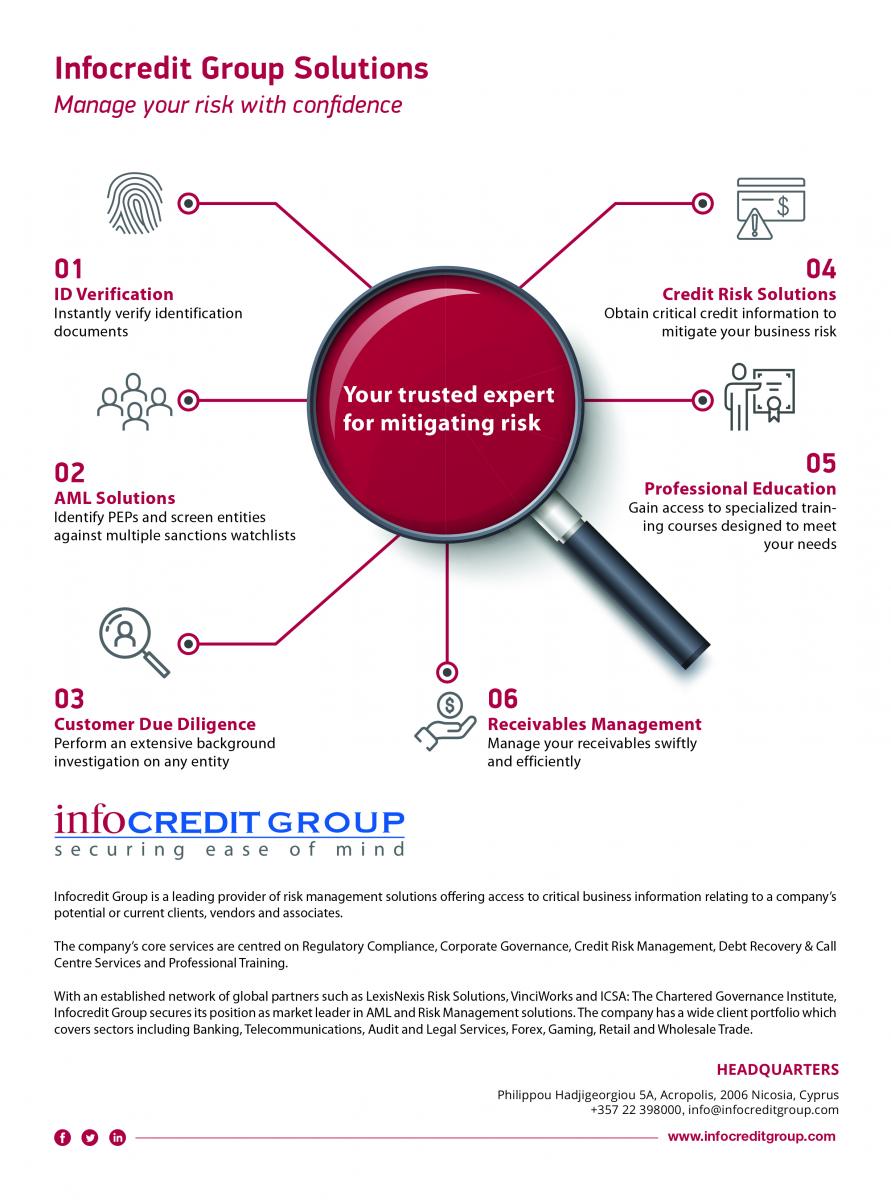

CSR AS A WAY OF LIFE

We are actively making an effort to increase our Corporate Social Responsibility (CSR) activities since we want our company to play a part in contributing to society and respecting fellow citizens or peers as well as the environment on every level. Sustainable growth, with the smallest environmental footprint possible, is a way of life for Infocredit Group and one that will determine our future steps. Infocredit Group is a leading provider of risk management solutions offering access to critical business information relating to a company’s potential or current clients, vendors and associates. The company’s core services are centred on Regulatory Compliance, Corporate Governance, Credit Risk Management, Debt Recovery & Call Centre Services and Professional Training. With an established network of global partners such as Lexis Nexis Risk Solutions, VinciWorks and ICSA: The Chartered Governance Institute, Infocredit Group secures its position as market leader in AML and Risk Management solutions. The company has a wide client portfolio which covers sectors including Banking, Telecommunications, Audit and Legal Services, Forex, Gaming, Retail and Wholesale Trade as well as Government organisations and Municipalities.

WE AIM TO REMAIN THE LEADING PROVIDER OF MODERN SOLUTIONS FOR CREDIT RISK MANAGEMENT, REGULATORY COMPLIANCE AND CORPORATE GOVERNANCE

nike lunar forever 2 mens cheap shoes sale store